January 4, 2010

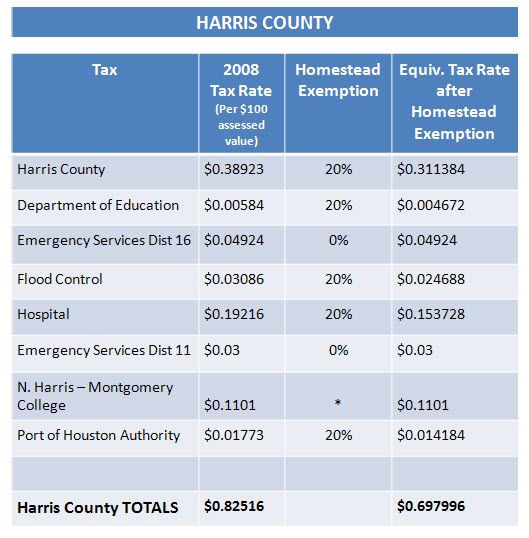

Content UPDATED for 2021 – filing for a homestead exemption is still the easiest way to save money on your real estate taxes. These days we are all looking for ways to save money whether it be on our grocery bill or our real estate tax bill. The easiest way to save money on your Spring Texas […]