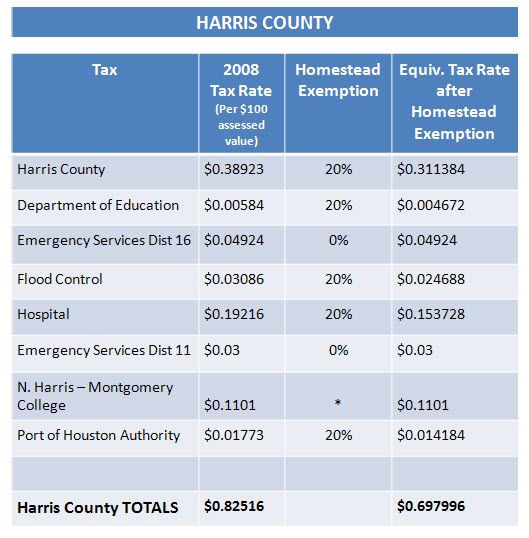

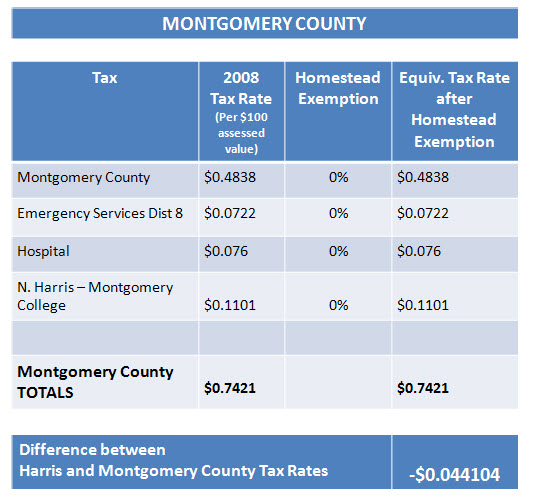

If I was to do a telephone survey to Montgomery county homeowners to find out the answer to “Who has lower real estate taxes Montgomery county or Harris county?” I would predict 80% of the survey respondents would say Montgomery county. And they would be partially right.

Partially right because Montgomery county real estate taxes are lower than Harris county real estate taxes if you DO NOT take into consideration the 20% residential homestead exemption available to Harris county homeowners.

Montgomery county on the other hand does not offer its homeowners a residential homestead exemption.

Maybe the question should be reworded to “Who has lower real estate taxes Montgomery county or Harris county after the homestead exemption?”

The answer and bragging rights would go to Harris county. After the homestead exemption the difference between the two counties real estate taxes is a minuscule difference. A difference not significant enough to base an entire home purchase decision on but a difference none the less.

There are lots of things to base your home purchase decision on such as commute time to work, community amenities, school district, floor plan, and overall tax rate. As a homebuyer don’t limit your home search to only homes in Montgomery county because a co-worker told you Montgomery county real estate taxes are less. Although your co-worker had good intentions, he was only partially right.

If you click on the charts, you will receive a larger more eye friendly version of the charts.

Read also:

- How to file for the homestead exemption and reduce your Spring Texas real estate taxes

- Why are Texas real estate taxes so high?

The Harris County real estate taxes chart is for homes located in the Windrose subdivision while the Montgomery County real estate taxes chart is for homes located in the Spring Trails subdivision.