I think we all know that over the long-term buying a home instead of renting is the better financial decision. Homeownership provides us with the financial benefits of tax savings, the ability to build up equity, and the opportunity for price appreciation.

But homeownership is not for everyone. You need to evaluate your situation and determine if now is the right time to buy a home. As there will be times in your life when owning a home is not the best financial decision.

How do you know if now is the right time for you to own a Spring Texas home? And where should you even begin to figure it out?

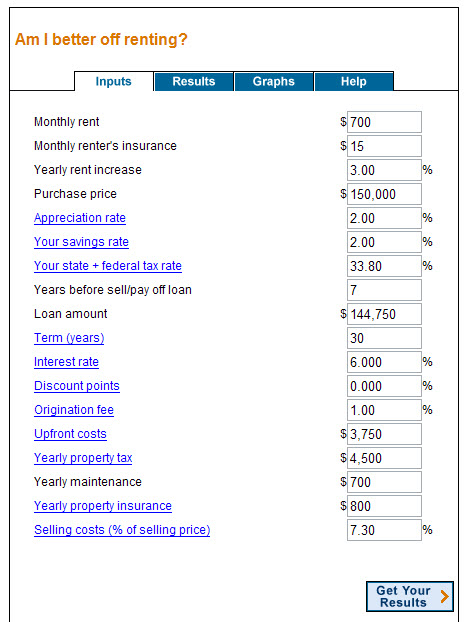

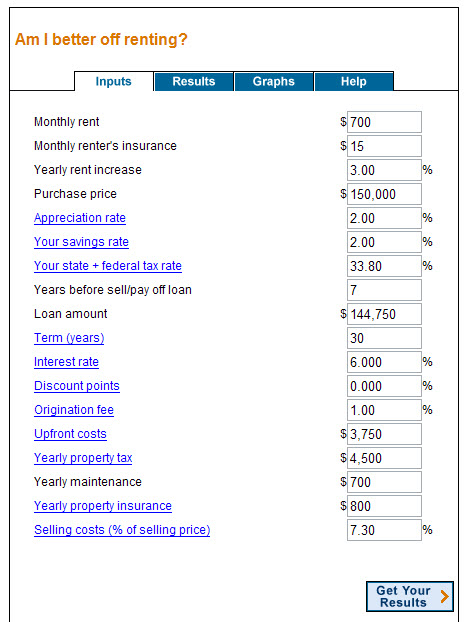

I think the best place to begin is by calculating “what if” scenarios with a rent vs buy calculator. A rent vs buy calculator will include in its calculation more than just the difference in the monthly mortgage payment and the monthly rent payment. A rent vs buyer calculator also considers yearly rental increases, the purchase price of the home, the term of your loan, the mortgage interest rate, buying and selling costs, the anticipated price appreciation rate for the Spring Texas real estate market, your tax rate, the cost of homeowners insurance, the annual real estate taxes, and the annual cost of home maintenance.

I know some of these items are difficult at best to estimate so be as conservative as possible with your estimates. On the items that you are totally at a lost how much to estimate, ask your friends or co-workers who live in Spring Texas how much their expenses are, ask a lender to provide you with an estimation of closing costs, and ask a Spring Texas Realtor what you should estimate for real estate taxes and how much you should estimate for price appreciation. To help you out, I would estimate real estate taxes at 3% of the purchase price and a conservation rate for price appreciation would be 2.0%. The Spring Texas real estate market is rather stable in comparison to other real estate markets in the U.S.