April 30th, 2010 has come and gone and with it the expiration of home buyers tax credits. Well almost .. as the tax credit does continue until April 30, 2011 for qualified military personnel but for the majority of home buyers the fat lady has sung and the party is over.

Will the expiration of the home buyers tax credit negatively affect the real estate market? Will renters want to stay renters? Is now still a good time to buy a home? What’s next for the Spring Texas real estate market?

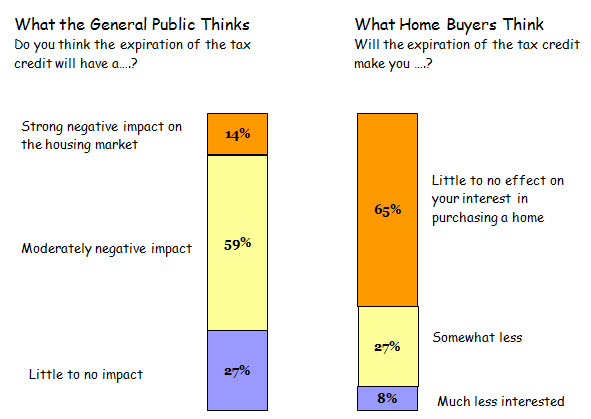

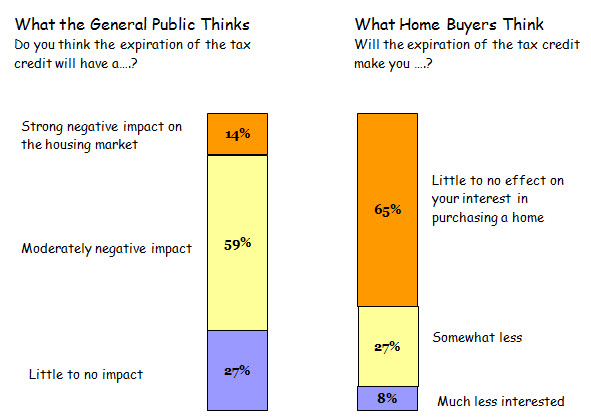

According to a April online studycommissioned by Prudential Real Estate of 800 random consumers, consumers are still optimistic about the real estate market with 65% stating the expiration of the home buyers tax credits will have little or no impact on them.

In hopes of attracting a first time home buyer seeking a tax credit, numerous sellers rushed to put their homes on the Spring Texas real estate market. The end result has been a larger supply of homes than demand for homes. This study is encouraging news for the many sellers who have their house on the market and are thinking all the buyers are gone.

Read also: