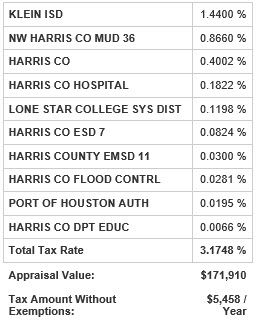

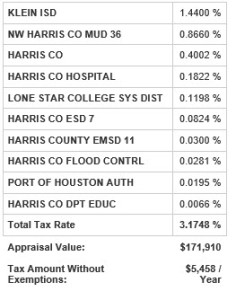

When you are considering buying a Spring Texas home, there are a couple of things you need to know about real estate taxes.

1.  Tax Amount Without Exemptions – The real estate taxes identified on a home’s listing is BEFORE / WITHOUT exemptions. You may qualify for a homestead, over 65, or disabled exemptions. All of these exemptions will reduce your Spring Texas real estate taxes. How much lower the real estate taxes will be for a property depends upon the exemptions and its location. Read more about homestead exemptions

Tax Amount Without Exemptions – The real estate taxes identified on a home’s listing is BEFORE / WITHOUT exemptions. You may qualify for a homestead, over 65, or disabled exemptions. All of these exemptions will reduce your Spring Texas real estate taxes. How much lower the real estate taxes will be for a property depends upon the exemptions and its location. Read more about homestead exemptions

2. Tax Rates may be the prior year’s rates – The current year’s tax rates are adopted around the September or October time frame of the tax year. The tax rates on real estate websites may reflect the prior year’s tax rates and not the current year’s tax rates. The tax rates vary from year to year.

3. Tax assessed value – The county appraisal district establishes the tax assessed value as of the first of the tax year. The taxes on real estate websites reflect the prior year’s tax assessed value until the current year’s tax assessed value is certified.

Learn more about Spring Texas real estate taxes