Over the years, the secret behind how your credit score is calculated and how different “what ifs?” affect it have been guarded better than the Bush’s baked beans recipe . That is until recently as FICO has shared how different “what if?” scenarios can affect your credit scores .

Over the years, the secret behind how your credit score is calculated and how different “what ifs?” affect it have been guarded better than the Bush’s baked beans recipe . That is until recently as FICO has shared how different “what if?” scenarios can affect your credit scores .

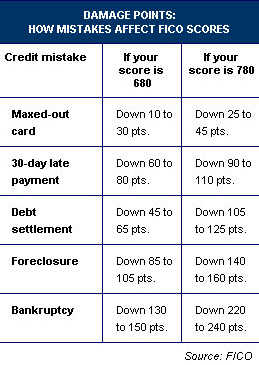

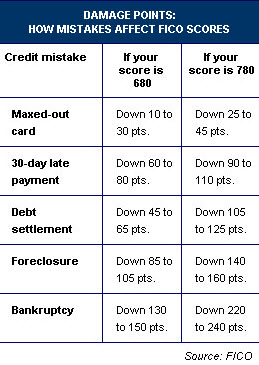

Did you max out your Macy’s card over Christmas? Expect a credit drop of 10 to 45 points. Did you get behind and had to make a 30 day late payment? That mis-step just cost you a whopping 60 to 110 points.

What I found most interesting about the damage points is how financial mis-steps are tougher on people with great credit scores. In a few years there will be less people with great credit scores and a lot more with only decent credit scores because the FICO credit rating system makes great credit scores tougher to keep.

I have been fielding more and more questions about credit and home loans lately. The questions are coming from both buyers and sellers. The two main questions are “Are buyers still able to get loans?” and “Are the lenders requiring higher credit scores?”. The answers to both these questions are “Yes”.

Lenders are still lending money and loans are still available. The documentation and verification process is more stringent than it was a couple of years ago. Credit scores have become more important too. A couple of years ago, a borrower could get a loan with a 580 or maybe a 560 credit score. That is not the situation today. If you need a loan in order to buy that house in Spring Texas you want, you are going to need a minimum of a 620 credit score.

Read also: