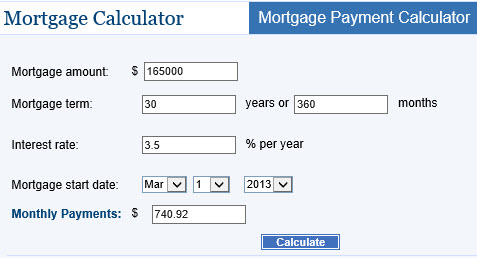

If you are thinking about buying a Spring Texas home, one of your first questions is probably “How much will my monthly mortgage payment be?” Good question and should be an easy question to answer. Just Google “online mortgage calculators” and you will have numerous calculators to choose from including the one below which is provided by Bankrate.com

The + of online mortgage calculators:

1. You can quickly calculate the Principal and Interest (P+I).

2. You can perform various “what if” scenerios based upon mortgage amount, interest rate, and term of loan.

The – of online mortgage calculators:

1. The simpler calculators do not include all the costs included in a monthly mortgage payment. They may only include Principal and Interest (P+I) and not Insurance, Taxes, and Private Mortgage Insurance (PMI).

2. The assumptions the sophisticated calculators utilize for homeowners insurance and real estate taxes are not always accurate.

3. Some of the sophisticated calculators require you to estimate the homeowners insurance and real estate taxes. The information that you use may be incorrect.

For instance … Did you know that the annual taxes you see listed for a property on a real estate website is before exemptions you may be entitled to? If a house in Spring Texas is located in Montgomery County, the real estate taxes after exemptions will not be significantly lower. But if a house in Spring Texas is located in Harris County, the real estate taxes after exemptions can be significantly less.

Bottom line – Mortgage calculators are good for providing you with rough estimates. But before you fall in LOVE with a Spring Texas house, have your loan officer put together a cost worksheet. The cost worksheet will estimate your entire monthly mortgage payment, your required down payment, and the closing and prepaid costs.

Read also: