In Spring Texas, the real estate tax rate is a combination of the tax rates of the school district, the county, and the MUD. The GOOD NEWS is the tax rates for each of these taxing entities have either declined or remained the same over the last couple of years. The BAD NEWS is the property values for Spring Texas homes have increased over the same time frame. Since the increase in property values has been higher than the decline in the tax rate, the net result is a higher instead of a lower property tax bill.

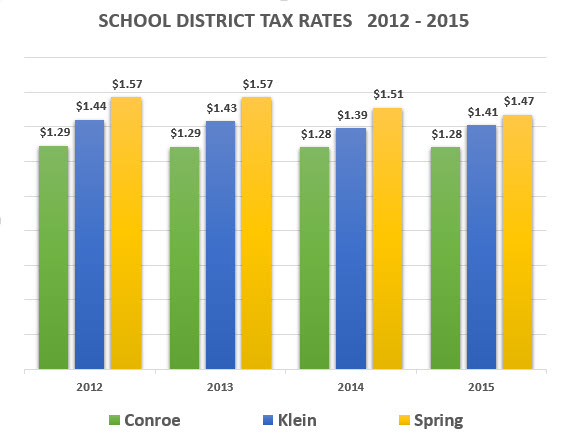

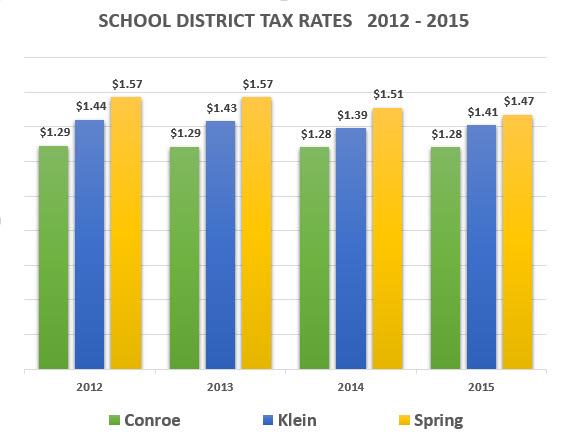

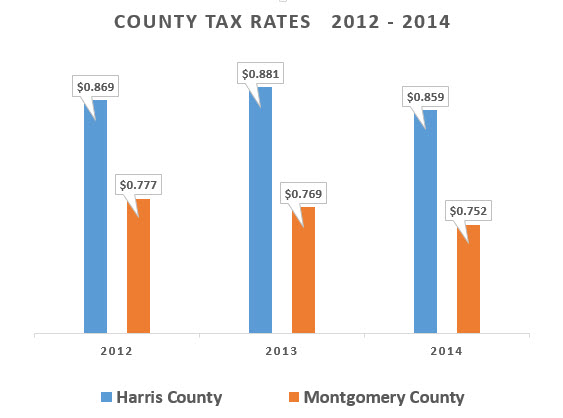

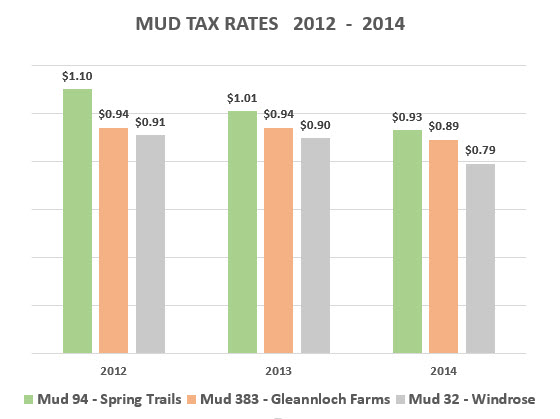

Below are charts showing the school district, county, and MUD tax rates over the last couple of years. All tax rates are per $100 of tax assessed value.

The tax rates represented for Harris County and Montgomery County include the county’s base tax rate and the tax rates for the flood control district, the port of Houston authority, the hospital district, the department of education, the Lone Star college district, and the emergency services district. The tax rates represented DO NOT include the homestead exemption as not all property owners qualify for a homestead exemption. Harris County offers a homestead exemption. Montgomery County DOES NOT offer a homestead exemption.

The MUD tax rates represented are for Montgomery County MUD 94 which provides service to the Spring Trails subdivision, Harris County MUD 383 which provides service to the Gleannloch Farms subdivision, and Harris County MUD 32 which provides service to the Windrose subdivision.

The MUD tax rates represented are for Montgomery County MUD 94 which provides service to the Spring Trails subdivision, Harris County MUD 383 which provides service to the Gleannloch Farms subdivision, and Harris County MUD 32 which provides service to the Windrose subdivision.

Read also: