January 2, 2012

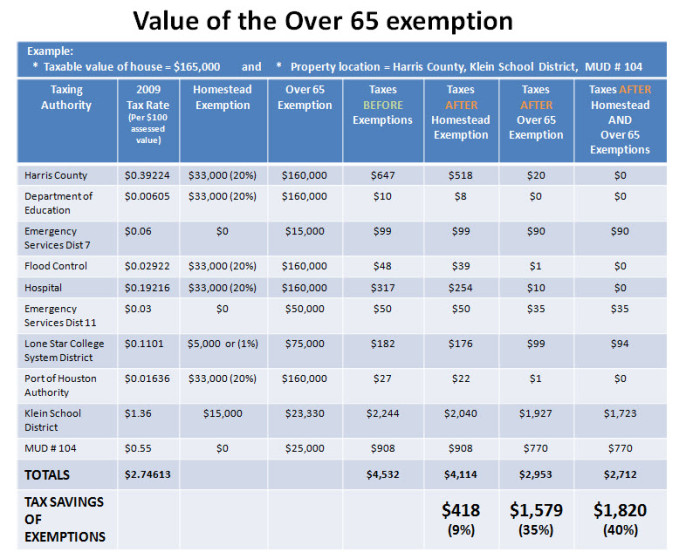

If you bought a home in Spring Texas in 2021, the first year you will be eligible for a homestead exemption is 2022. One of the eligibility requirements for the homestead exemption is you have to own the home on January 1st of the tax year. The benefit of a homestead exemption is it reduces […]