May 23, 2021

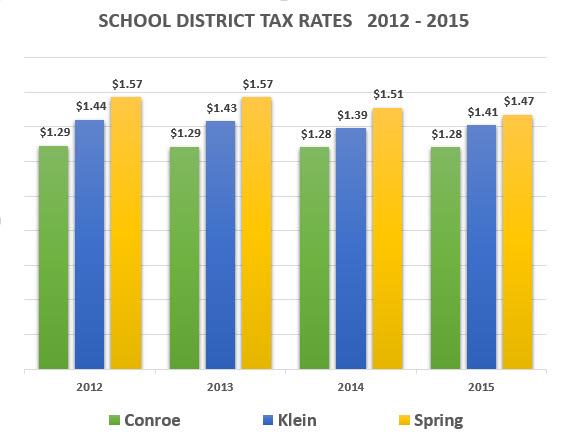

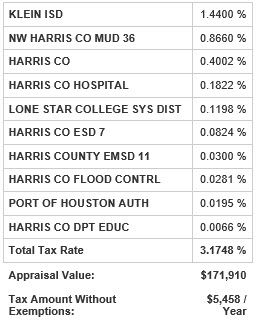

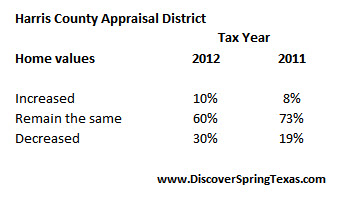

Moving to Spring TX? 5 Things you NEED to know about real estate taxes. Spring Texas real estate taxes are HIGH. Texas has no state income tax which is the good news. The bad news is our real estate taxes are HIGH. It’s through our real estate taxes that we pay for public services including […]