Its TRUE … if you compare Spring Texas property taxes to other states they are higher. But WHY are they higher? Because Texas has NO state income tax. Thus we pay for our schools, roads, infrastructure, and social services through our property taxes.

Our real estate taxes have three components…..

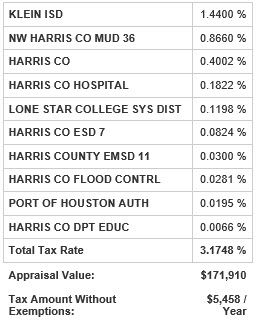

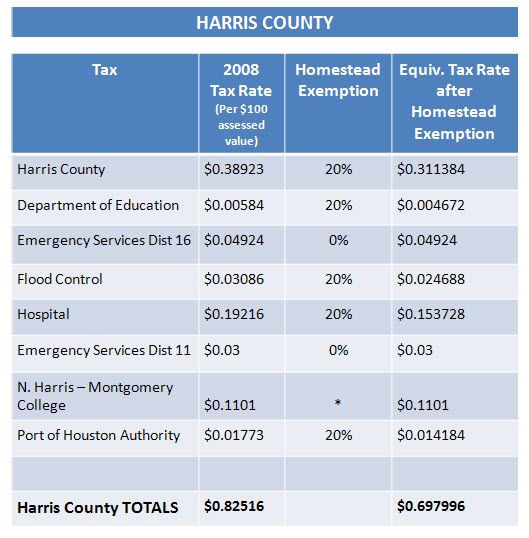

1) County tax – Homes in Spring Texas are located in either Harris County or Montgomery County. The county tax is composed of the county, county flood control, port of Houston authority, county hospital district, county education department, junior college district – Lone Star college system, county emergency service district – fire, and the county emergency service – ambulance. The 2021 tax rate for Harris County is approximately $0.79 and for Montgomery County it is approximately $0.70. The rates are for every $100 of assessed property value.

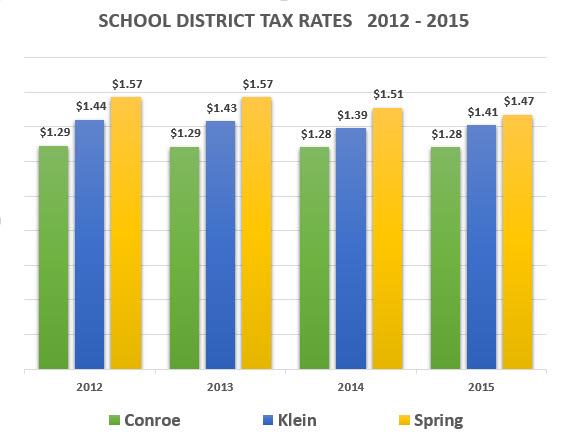

2) School District tax– Tax assessed by the school district that the property is located in. Homes located in Spring Texas are going to be in either the Conroe school district, the Klein school district, or the Spring school district. The 2022 tax rates for the Conroe, Klein, and Spring school districts are $1.11, $1.23, and $1.25, respectively. All rates are for every $100 of assessed property value.

3) MUD (Municipal Utility District) tax– MUDs are the political entities which provide water and sewer services to the majority of residential and commercial property owners who do not receive those services from the City of Houston. The MUD tax rates range from $0.00 to $1.40 per every $100 of assessed value. Some of our older subdivisions that were developed in the late 1970s do not have a MUD tax because the bonds have been repaid.

The total combined tax rate of 1) County + 2) School District + 3) MUD = $2.10 to $3.58 per $100 of assessed value. The average combined tax rate in the Spring Texas area is $2.60. For a home with an assessed value of $300,000, the property tax burden before homestead, over 65, or disability exemption would range from $6,300 to $10,740 a year. The school district and the MUD taxes combined represent 50% to 80% of the total property tax burden.

All of the tax rates for the current tax year are released around the October / November time frame.

One more thing on the subject of real estate taxes is you may qualify for a homestead exemption that will REDUCE your total tax bill.

Below is additional information on our property taxes, how to qualify and receive tax exemptions, how to protest your taxes, and whether real estate taxes will be increasing or decreasing.

May 23, 2021

Moving to Spring TX? 5 Things you NEED to know about real estate taxes. Spring Texas real estate taxes are HIGH. Texas has no state income tax which is the good news. The bad news is our real estate taxes are HIGH. It’s through our real estate taxes that we pay for public services including […]

February 12, 2016

You think your Spring Texas home has a homestead exemption but you are not 100% sure. So how can you easily find out if you have a homestead exemption? At the Harris County Appraisal District website of www.hcad.org you can look up your account and see which if any exemptions have been applied to your […]

January 1, 2016

There’s an APP for that. It seems like an APP exists for almost everything you want to do including filing for a homestead exemption on your Spring Texas home. The Harris County Appraisal District’s new APP allows you to easily file and then track the status of your homestead exemption. No more printing, filling out, […]

December 26, 2015

Spring Texas encompasses two counties (Harris County and Montgomery County), three school districts (Conroe, Klein, and Spring) and numerous MUDs (Municipal Utility Districts). Property tax rates vary based upon a subdivision by subdivision basis. The biggest difference between the property tax rates of individual subdivisions is in the MUD tax. The MUD tax declines as […]

October 25, 2015

In Spring Texas, the real estate tax rate is a combination of the tax rates of the school district, the county, and the MUD. The GOOD NEWS is the tax rates for each of these taxing entities have either declined or remained the same over the last couple of years. The BAD NEWS is the […]

October 19, 2015

UPDATED: With a 86% in favor Vote State Proposition 1 PASSED. State Proposition 1 – the Homeowner Tax Relief Proposition increases the state minimum homestead exemption for public schools from $15,000 to $25,000. The last time the homestead exemption was increased was in 1997 at which time it increased from $5,000 to $15,000. With the passing of State […]

October 10, 2013

When you are considering buying a Spring Texas home, there are a couple of things you need to know about real estate taxes. 1. Tax Amount Without Exemptions – The real estate taxes identified on a home’s listing is BEFORE / WITHOUT exemptions. You may qualify for a homestead, over 65, or disabled exemptions. All […]

March 23, 2012

The Harris County appraisal district has finished their assessment of residential home values and not the bill but the value will soon be arriving in your mailbox. How will your Spring Texas home fare? Will your home’s tax value be higher, lower, or stay the same? For the majority of Harris County homeowners the tax assessed value of their homes will […]

March 7, 2012

Has this situation ever happened to you? After hearing a knock on your front door, you get up to see who it is. But instead of finding a girl scout selling cookies on your front porch, you find an appraiser from the Harris County Appraisal District. After showing you his identification badge and introducing himself, the appraiser […]

January 2, 2012

If you bought a home in Spring Texas in 2021, the first year you will be eligible for a homestead exemption is 2022. One of the eligibility requirements for the homestead exemption is you have to own the home on January 1st of the tax year. The benefit of a homestead exemption is it reduces […]

December 17, 2011

In Spring Texas, our property tax system is comprised of four stages: 1. Appraising the taxable property, 2. Reviewing and equalizing the appraised values, 3. Adopting the tax rates and 4. Collecting the taxes. Appraising the taxable property – Residential properties in Harris County are appraised as of January 1st of the tax year. An appraised value and a market value is […]

April 27, 2011

Do you think the Spring Texas real estate market improved last year? If you think the real estate market was relatively unchanged last year, the Harris County Appraisal District (HCAD) agrees with you. The Harris County Appraisal District is the organization responsible for appraising all commercial and residential real estate in Harris County as of the first of each […]

February 23, 2011

Are you looking for ways to cut your income taxes? Do what 34.6 million taxpayers already do to cut their taxes. They own a home and deduct the interest they paid on their home mortgages. The mortgage interest deduction cuts their federal income taxes by a total of nearly $77 billion. What are the tax advantages of owning […]

January 28, 2011

Top 3 things you need to know about Spring Texas real estate taxes: 1. You did NOT file for your homestead exemption at closing. Although you signed a pile of documents when you closed on your Spring Texas house, the homestead exemption form was not one of them. You can only file for the homestead exemption between January 1st […]

January 8, 2011

If you bought a home in Spring Texas in 2010, you have until April 30th to file for a residential homestead exemption. The homestead exemption will reduce the tax assessed value of your house which saves you money on your Spring Texas real estate taxes. There are additional exemptions available which may reduce your real estate taxes even further including […]

May 22, 2010

If you haven’t filed a protest of your Spring Texas real estate taxes yet, you still can. But don’t wait too much longer as the protest deadline is June 1st. Once you decide to protest the tax assessed value of your Spring Texas house, the next decision you have to make is do you protest the value yourself […]

April 15, 2010

Today is April 15th. The day the majority of us associate with as the day our income tax returns are due. I am not going to write about income taxes. Although I do have an accounting degree, I am not qualified to give advice on the many changes in the income tax laws. What I am […]

February 19, 2010

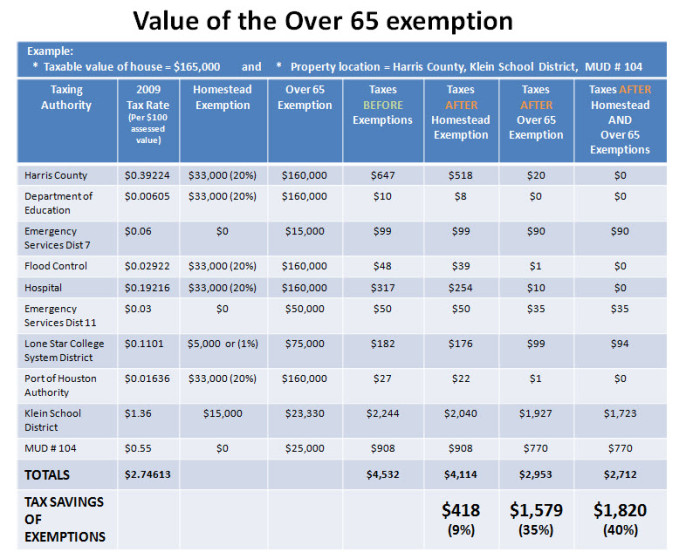

Are you going to be turning 65 soon? If so, you are probably already aware that you are eligible for Medicare. But did you know you will be eligible for a reduction in your Spring Texas real estate taxes? That’s right another reason to get excited about turning 65. Unlike the homestead exemption that comes with restrictions […]

January 4, 2010

Content UPDATED for 2021 – filing for a homestead exemption is still the easiest way to save money on your real estate taxes. These days we are all looking for ways to save money whether it be on our grocery bill or our real estate tax bill. The easiest way to save money on your Spring Texas […]

July 6, 2009

If I was to do a telephone survey to Montgomery county homeowners to find out the answer to “Who has lower real estate taxes Montgomery county or Harris county?” I would predict 80% of the survey respondents would say Montgomery county. And they would be partially right. Partially right because Montgomery county real estate taxes […]

April 23, 2009

By now your Spring Texas property tax notice from the Harris County Appraisal District (HCAD) should have arrived in your mailbox. If you have not received your valuation yet the odds are in your favor that your property value will either decrease or remain the same as 2008. According to HCAD, 45% of the residential properties in Harris County received […]

January 5, 2009

These days we are all looking for ways to save money whether it be on our grocery bill or our real estate tax bill. The easiest way to save money on your Spring Texas real estate taxes is by filing for the general homestead exemption. And it is as easy as cutting coupons out of the Sunday […]

November 24, 2008

Its that time of the year, again. The time of year I dread going to my mailbox because I know any day now lurking inside I will find the bills for my Spring Texas Property Taxes. In Spring Texas, we have three taxing entities the MUD (Muncipal Utility District), the school district which can either be […]

August 21, 2008

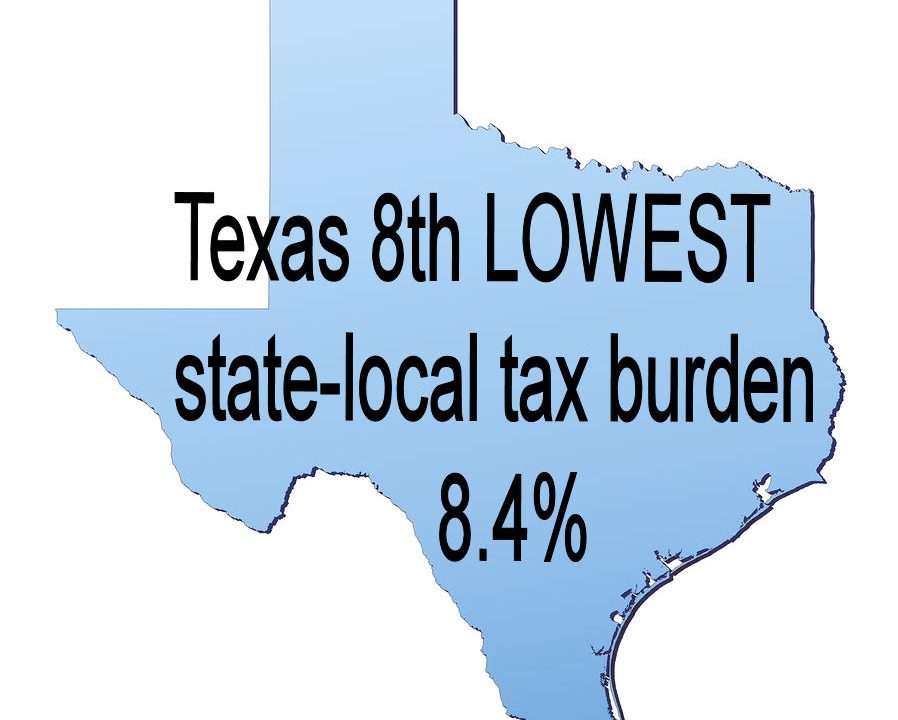

There is no denying that our real estate taxes in Spring Texas are higher than in other states. But you shouldn’t ONLY take into consideration real estate taxes when considering whether its affordable to live in Spring Texas. For 18 consecutive years the nonpartisan Tax Foundation has published an estimate of the combined state-local burden […]

May 15, 2008

The residents of Spring Texas have spoken and what they have said is “We want quality education”. On May 10th, the residents of Klein School District voted on a $647 million school bond. The bond PASSED with 52% of the votes. Every vote counts as the bond passed by a narrow margin of only 300 […]

March 25, 2008

One of the bad things about growth is that sooner or later we are going to have to pay for its impact on our infrastructure. And pay we do, usually in the form of increased taxes. Over the last four years, our Klein school district has experienced growth. Growth of more than 16% or 6,000 […]

March 6, 2008

In previous years, we typically would receive the notice of appraisal value of Spring Texas homes in April. We would have until May 31st or 30 days after the date the appraisal district sent the notice whichever is later to protest the value. But for 2008, the dates have changed. You now have until April […]

February 6, 2008

If you ask Spring Texas Realtors how much is the Homestead Exemption for homes in Spring Texas, the majority of them will tell you that its 20%. The sad part is that this is just NOT True. The TRUTH is it depends. Now I know that sounds like a vague answer, but let me further […]

January 2, 2008

One of the easiest ways to Reduce your Spring Texas property taxes is by filing for your homestead exemption. The homestead exemption removes part of the assessed value of your property from taxation and thus lowers your real estate taxes. The assessed value of your home is the value placed on your home by either […]

December 28, 2007

In a comparison with other school districts in the greater Houston Texas metropolitan area, Klein school district has the second lowest property tax rate. Klein school district is located in Spring Texas. The Klein school district property tax rate for 2007 is $1.26 per $100 valuation. The award winning Klein schools offer a good public […]

October 11, 2007

I must say that just writing the words Property Tax Decrease is a little weird. But its true Klein school district in Spring TX approved a 32 cent property tax rate decrease from the 2006 rate for 2007. Now 32 cents may not sound like a lot, but with the median home price of $160,000 […]

July 22, 2007

I am often asked why are property taxes in Texas are so high? The simple answer is because Texas does not have a state income tax and thus our schools, social services, roads, and infrastructure are supported by a property tax. Although they may seem high, our overall tax burden in Texas is much lower […]